It's a great savings account that keeps growing on you.

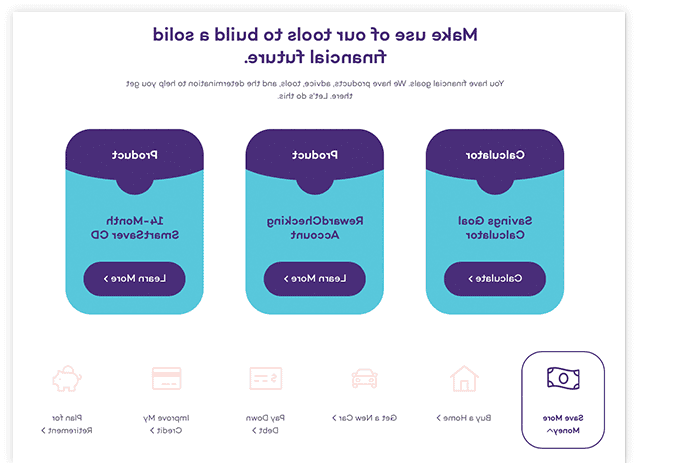

A favorite pet. Baltimore crab cakes. A classic movie. Some things in life seem almost perfect. A MECU Credit Union CD fits the bill financially. After all, where else can you get higher interest rates than are offered by most savings account without risking one penny of your hard-earned money.Equally good for the short haul or the long run

One great CD feature is that you control the investment period. Bracing for next semester's tuition bill? Try a 6 month CD. Dreaming of a new car a few years down the road? Go for a 36-month CD. Or consider opening several certificates, with different terms, so you'll have money available whenever you need it.- $500 minimum opening deposit1

- Available as Fixed, Traditional IRA or Roth IRA CDs2

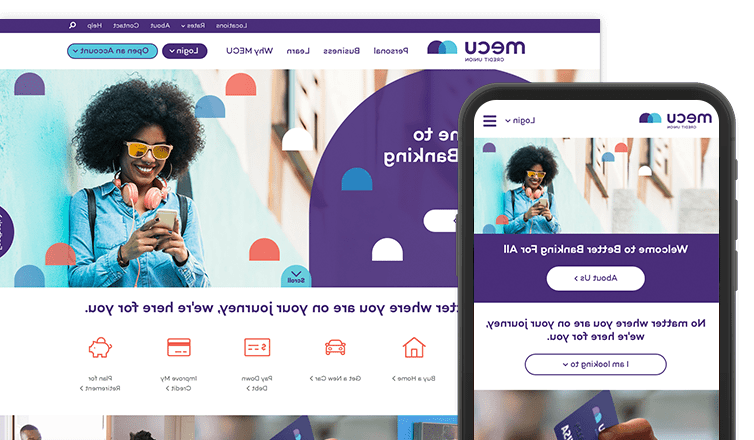

- Watch your saving grow with Online Banking or Mobile Banking

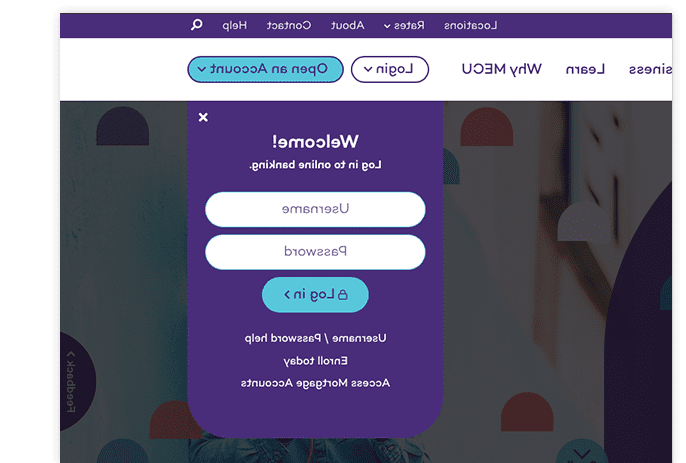

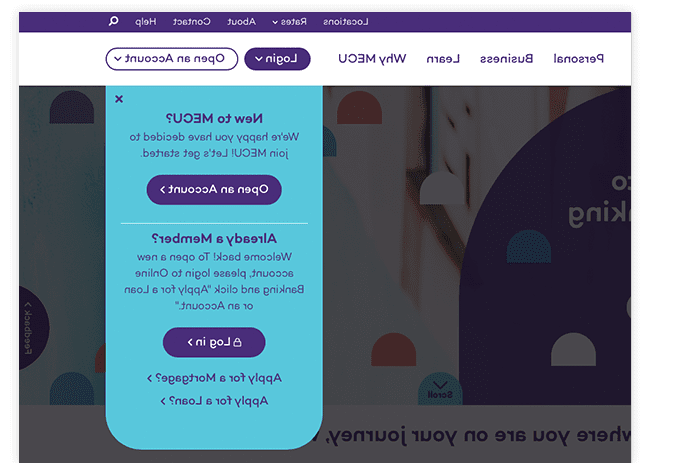

Already a MECU member? Follow the steps below to open your CD:

- Log in to Online Banking

- Navigate to "Apply for a Loan or Account"

- Select "Open an Account"

- Click "Secondary Account"

2 Early withdrawal penalty may be imposed for withdrawal of principal before the maturity date.